Bank Of Canada Mortgage Rates Forecast

Bank of Canada holds key interest rate at 025 cuts growth forecast for 2021. 134 prime 111 Lowest nationally available mortgage rates.

This News Could Not Be Found Central Bank Canada Bank

The Bank of Canada Is Forecast To Hike Rates 3-Months Early.

Bank of canada mortgage rates forecast. 5 This figure equals the year-end 2021 overnight rate forecast from major economists as tracked by Bloomberg plus a 220-basis-point spread which is the current spread between prime rate and the overnight rate. However ahead of Central Bank interest rates the market trader driven Government of Canda Bond Yield will continue independently of the Central Bank Rate to be more closely tied correlated to fixed mortgage rates. So borrowers can remain confident of low borrowing costs until at least this time.

Royal Bank is the only forecaster calling for a rise in the Target Rate by September 2022. That means a fixed five-year rate of 21 per cent for the remainder of this year along with a 15 per cent variable rate available through 2022. The posted rates cover prime rate conventional mortgages guaranteed investment certificates personal daily interest savings and non-chequable savings deposits.

Rates are forecast to have a downside of 46 in 2022 and an upside of 620. Take precedence in determining mortgage rates whenever that might be we expect fixed rates to gradually rise back to pre-pandemic levels while variable rates follow the Bank of Canadas timetable. The data shown is to provide information on the weekly posted interest rates offered by the six major chartered banks in Canada.

Above we have predicted that the Bank of Canadas Target Overnight Rate will remain at 025 for 2021 and rise to 050 in 2022. Every economist surveyed expects the Bank of Canada BoC will keep its Target Rate at the effective lower bound of 025 until the second half of 2022. Fixed rates have already been constantly climbing over the past few weeks and observers say they are likely to take another lead.

Bank of Canada Mortgage Rate Trends February 2 2021 While Canadas economy recorded its largest-ever annual GDP drop of 51 last year its also on track to post a comeback in Q4 which could force the Bank of Canadas hand in reining inflation in sooner than anticipated. The average for the month 245. The 1-year fixed rate forecast has risen to an average of 300 for 2022.

In 2023 the range rises to 470 to 660 for the full year. So for any mortgage you must first begin with the overnight rate as set by the Bank of Canada. 2185 Theatre Lane Oak Bay BC V8R 6T1.

By next year the posted 5-year fixed rate is forecast for an even higher maximum breaching the 6 point mark. 099 prime 146 5-year Variable Uninsured. Mortgage Interest Rate forecast for January 2022.

The decision by The Bank of Canada to hold their lending interest rate at 5 is an indicator of the future. The banks therefore incur a cost in the transaction of money at the rate of the overnight target. That would put rates at double todays level highlighting how low.

The prime rate is now at 27 for the foreseeable future. The Bank of Canada has said that it will hold the policy interest rate at 025 until the economy recovers and inflation reaches a consistent 2 percent. That would mean a Bank of Canada target rate of 225 by the end of 2023well above its current level of 025 and higher than any other bank forecast.

From 2023 onwards the outlook is less certain and highly dependent on global macroeconomic factors. No rate hikes are expected when the Bank meets this Wednesday but all eyes will be on its statement and accompanying Monetary Policy Report for clues of a shifting outlook given the inflation and supply issues mentioned above. The central bank said it expects the economy to grow 60 in 2021 down from its previous forecast of 65.

Bank of Canada interest rate forecast report July 2021. This is a 20 basis point increase from the previous forecast. Updated April 23rd 2021.

Desjardins is also raising its forecast for the average mortgage rate posted next year. Bank of Canada Overnight Target. Canadian mortgages will rise especially shorter terms.

Short-term rates are heavily influenced by the overnight rate. That means a fixed five-year rate of 21 per cent for the remainder of this year along with a 15 per cent variable rate available through 2022. The choice to hold the lending interest highlights the potential for growth.

The 15 Year Mortgage Rate forecast at the end of the month 250. The average for the month 249. Inflation has never consistently reached 2 since the 2008 financial crisis.

This rate then gets passed on to anyone who wants to borrow money from the bank. Canadas central bank will be forced to accelerate its overnight rate hike schedule. As of Friday the large banks will continue to move fixed rates probably about 30 bp by the time the dust settles next Friday.

In a cheepButler Mortgages Ron Butler wrote that fixed mortgage rates will go up again. The Bank of Canada has said that it is committed to maintaining its Central Bank rate at 25 until at least 2023. Let the brokers compete for you.

Any lower rate would mean the bank is losing money by lending to you. However the Bank now expects growth of 46 in 2022 up from its earlier forecast of 37. 4 Prime rate is tracked by the Bank of Canada.

It equals the typical mode average prime rate of the six largest Canadian banks. The 15 Year Mortgage Rate forecast at the end of the month 248. Bank of Canada Interest Rate Forecast for the Next 5 Years.

Ad Access licensed mortgage brokers in your area. Maximum interest rate 258 minimum 236. The Canadian economy contracted in the second quarter with output falling 11 per cent on an annualized basis.

The BoC is now expected to increase rates by 25 basis points bps in July 2022. Maximum interest rate 255 minimum 241. Economists forecast a rate hold on July 14 with the majority 74 believe the rate will hold for just 12 18 months.

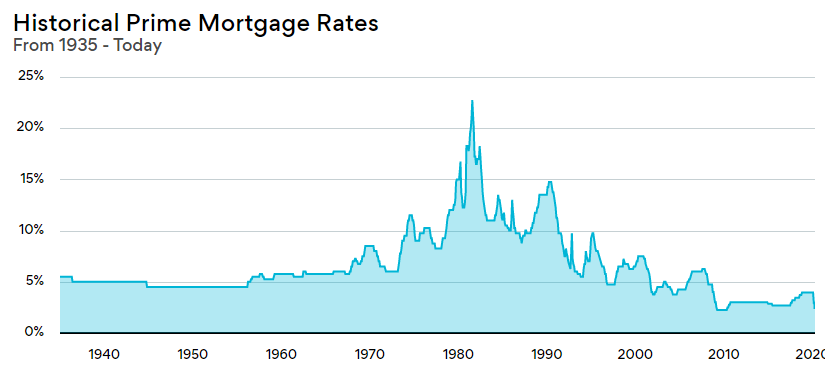

Bank Of Canada Interest Rate 1935 2021 2022 Forecast Wowa Ca

Os Consumidores Devem Ficar Atento Com O Prazo Para Recorrer A Justica Sobre Taxas Abusivas Como A Sat Emprestimo Consignado Imoveis Financiamento Imobiliario

The State Of The Canadian Debt Slaves And How They Compare To The American Debt Slaves Wolf Street Debt Consumer Debt Mortgage Debt

Prime Rate In Canada 2021 How To Save Money

Fed S Kaplan Expects Temporary Inflation Spikes During Recovery In 2021 Kaplan Federal Reserve Economic Activity

Canada Inflation Rate Historical Data Canada Chart

Boj Can T Normalize Won T Normalize September 2nd 2017 Canning Government Bar Chart

Canada Could Adopt Negative Interest Rates Within The Next Two Years Citi Says Interest Rates Negativity The Next

Cibc Bank Finance Banking Mobile Banking

Trade Finance Market Size Forecast In 2020 Finance Loans Finance Lead Generation Real Estate

Kiwi Headwinds Growing As Rbnz Keeps Option Of Negative Rates New Zealand Dollar New Zealand Business Confidence

Is 2015 The Year The Bank Of Canada Finally Raises Interest Rates National Globalnews Ca

National Bank Of Canada Forecasts Sharpest Real Estate Price Decline Ever Better Dwelling Real Estate Prices Vancouver Real Estate Real Estate Photographer

Overnight Bank Of Canada Rate Remains Unchanged Http Leslieblais Com 2014 03 05 Overnight Bank Of Canada Rate Remains Unchanged Canada Mortgage Near Future

Bank Interest Rate Forecast Uk 2022 Statista

Canada Interest Rate Canada Economy Forecast Outlook

Qe Party Over Bank Of Japan Stealth Tapers Further Bank Of Japan Japan Bank

Higher Capacity Gives Poloz Some Leeway On Rates Survey Data Gross Domestic Product Rate

Crea Updates And Extends Resale Housing Forecast Crea Ca Nova Scotia Real Estate Marketing Real Estate News